China’s Clean Tech Empire: The New Great Game of Power

Forget oil. Forget gas. Forget the dirty commodities that defined the last century. The new great game is being played in sunlight and wind, and China has already seized the high ground.

In 2024, China installed more solar and wind power than every other country combined. This isn’t just another statistic in the climate fight — it’s a tectonic shift in how power, both electrical and geopolitical, will be wielded in the decades to come. While the West argued over subsidies, China built factories, panels, turbines, and transmission lines at a scale that defies precedent. Today, it supplies more than 80% of the world’s solar panels and dominates the global battery trade. In clean energy, Beijing is not catching up — it has lapped the field.

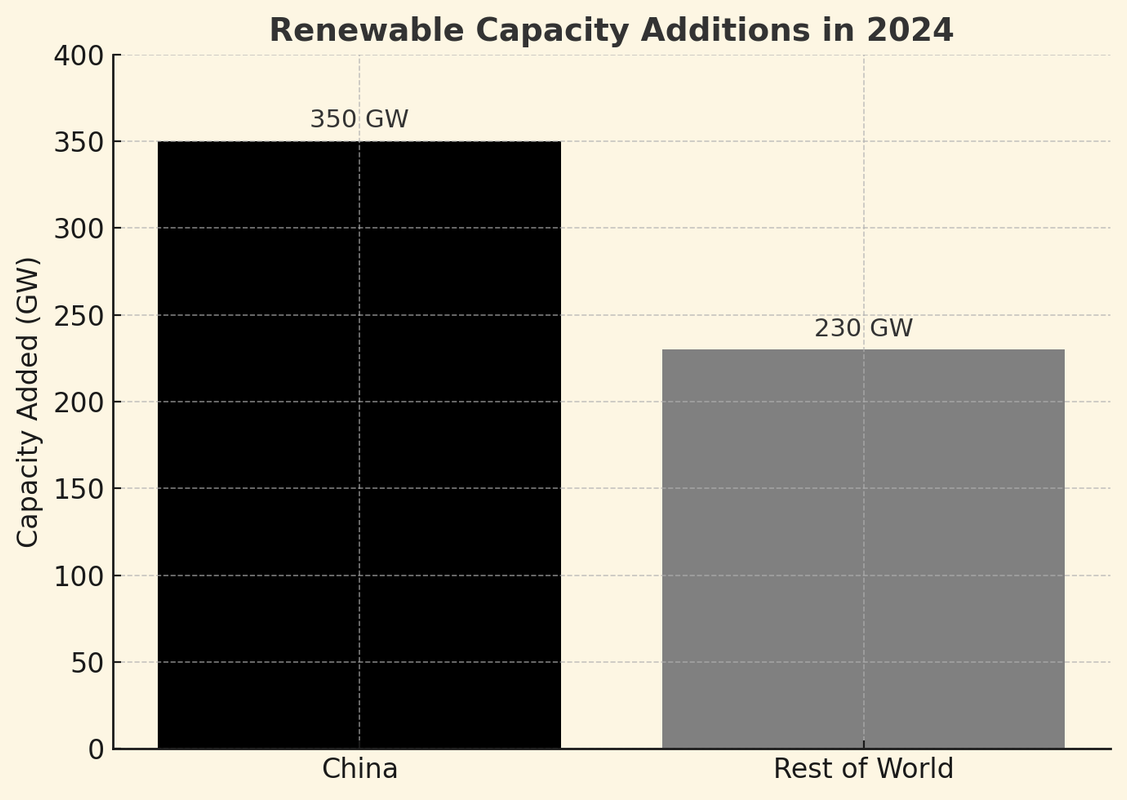

The scale of capacity

The International Energy Agency estimates that 60% of new global renewable additions in 2024 came from China alone. The numbers are stark: 350 gigawatts added by China compared to 230 gigawatts for the rest of the world combined.

This capacity surge reshapes markets. For every solar farm in Kenya, wind project in Brazil, or grid upgrade in Poland, the odds are overwhelming that the equipment was built in China. The Belt and Road Initiative has quietly morphed into a Green Belt and Road: not coal plants this time, but solar panels, lithium-ion batteries, and high-voltage cables.

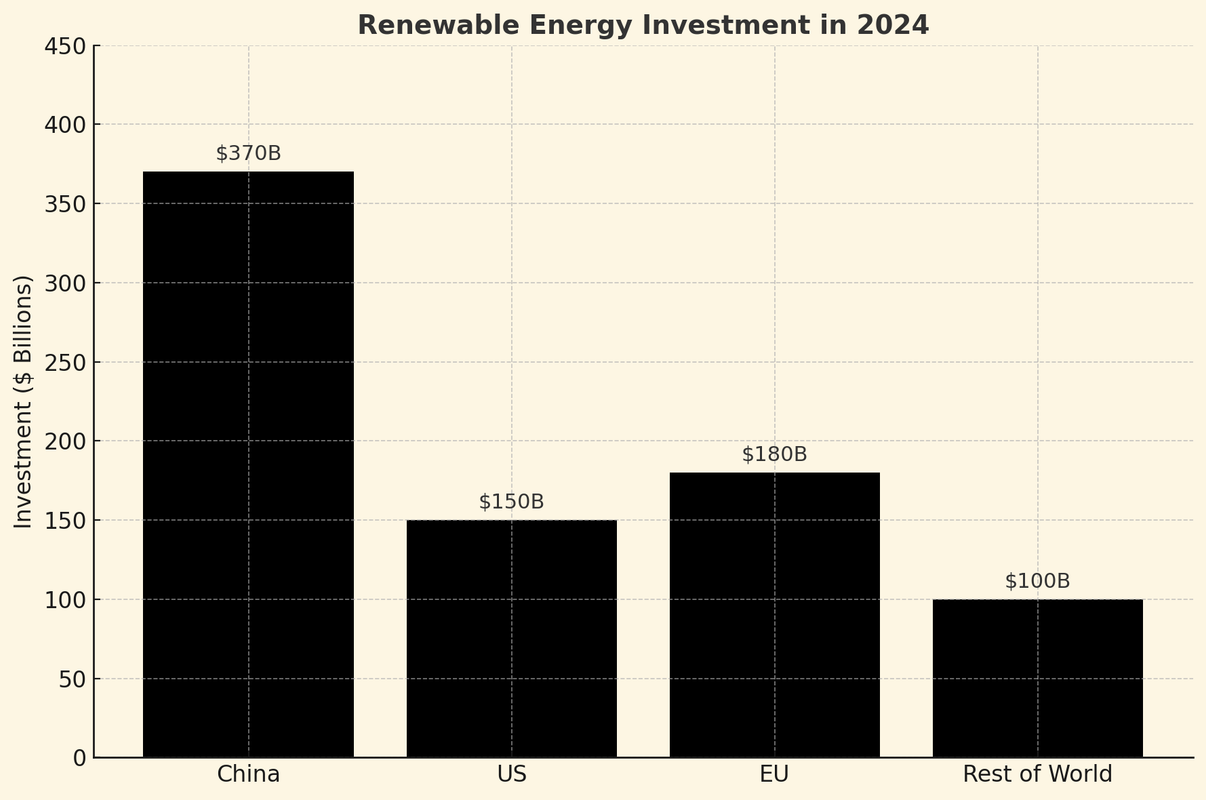

Financing the future

The transformation is not only physical but financial. China invested nearly $370 billion into renewables in 2024, outpacing both the United States and the European Union. Together, the US and EU mustered $330 billion, but fragmented across diverse suppliers and markets. China’s concentrated push has given it pricing power, control of supply chains, and leverage over global climate policy.

| Region | Investment ($B) |

|---|---|

| China | 370 |

| United States | 150 |

| European Union | 180 |

| Rest of World | 100 |

Geopolitics of sunlight

Ahead of COP30 in Brazil, the optics are undeniable. Western leaders long demanded that China “do more” on climate. It has — but in its own way. By scaling manufacturing and financing green energy, Beijing has married climate ambition with geopolitical leverage. Every wind turbine erected in Africa, every solar panel shipped to Latin America, is a subtle extension of China’s industrial reach.

This is good news, yes: the world is decarbonizing faster, and the costs of renewables are plunging. But it is also sharp news: the balance of global power in the 21st century is crystallizing not in oilfields, but in supply chains of solar panels and batteries. And Beijing has already crowned itself gatekeeper.

The global ripple effect

China’s rise in clean energy is not an isolated story. It intersects directly with the ambitions of developing nations trying to carve out sovereignty through power. In Southern Africa, Mozambique has just secured World Bank backing for the $6 billion Mphanda Nkuwa Dam — the largest such project in the region in half a century. By 2031 it could deliver 1,500 megawatts, enough to shift the country from energy dependence to regional power broker.

In the Horn of Africa, Ethiopia is completing the Grand Ethiopian Renaissance Dam on the Nile. At more than 6,000 megawatts, it will be the continent’s biggest hydroelectric source — and a geopolitical flashpoint with Egypt and Sudan, who fear the dam will alter the river’s lifeblood. Both Mozambique and Ethiopia illustrate a truth that mirrors China’s own path: energy projects are not just infrastructure, they are instruments of sovereignty and influence.

Where China leads in industrial scale, Africa is pushing forward with strategic projects of its own. Yet the common denominator is the same: in the twenty-first century, power is no longer measured in barrels of oil or bricks of gold, but in megawatts and gigawatts. Nations that master the flow of electrons will master their future.

From Beijing to Maputo to Addis Ababa, the logic is convergent. Build the capacity, secure the sovereignty, wield the leverage. Energy is the new gold, and the race to mint it is already underway.

Add comment

Comments