When the Mines Run Dry: The Hidden Timeline of Resource Scarcity

A 12-year-old's weathered hands clutch cobalt stones in the Democratic Republic of Congo. In Silicon Valley, engineers design the next iPhone. Between them lies a supply chain so fragile that a single disruption could halt the global energy transition.

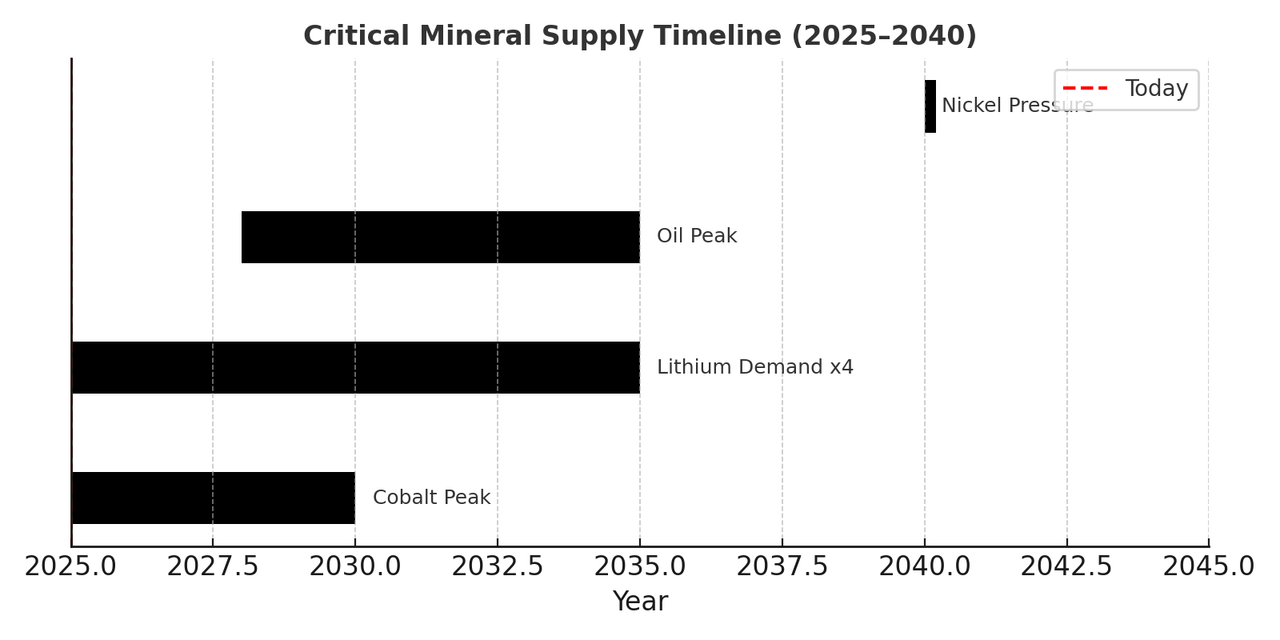

Every electric vehicle battery carries a hidden countdown timer. Cobalt production could peak within the next five years, lithium demand will quadruple by 2035, and the world still burns through 90 million barrels of oil each day. The real emergency is not whether minerals will run dry—it is whether our civilization can adapt before the crunch arrives.

The Human Cost of Our Digital Age

Muntosh is twelve years old and has already spent six years digging for cobalt in the mines of Lualaba province, Democratic Republic of Congo. His small hands, prematurely aged by years of manual labor, extract the mineral that powers electric vehicles in California and smartphones in London. When a landslide buried his brother alive—a common occupational hazard in these artisanal mines—Muntosh continued working. His family needs the $2-3 daily wage to survive.

"People are working in subhuman, grinding, degrading conditions. They use pickaxes, shovels, stretches of rebar to hack and scrounge at the earth in trenches and pits and tunnels," describes Siddharth Kara, a Harvard researcher who has documented the horror show of cobalt mining. Recent research shows that despite earning a "living wage" calculated at $501 monthly, most workers earn far less, trapping tens of thousands of miners in poverty while extracting materials essential for the global energy transition.

The paradox is stark: the clean energy revolution depends on extraction methods that would have seemed primitive centuries ago. Over 60% of the world's cobalt comes from the DRC, where unregulated mining has fueled deforestation, pollution, and substantial social challenges, including unsafe labor conditions and child labor. As of March 2024, 5,346 children in Lualaba and Haut Katanga provinces were registered in the Child Labor Monitoring and Remediation System database.

The Lithium Triangle: South America's Resource Reckoning

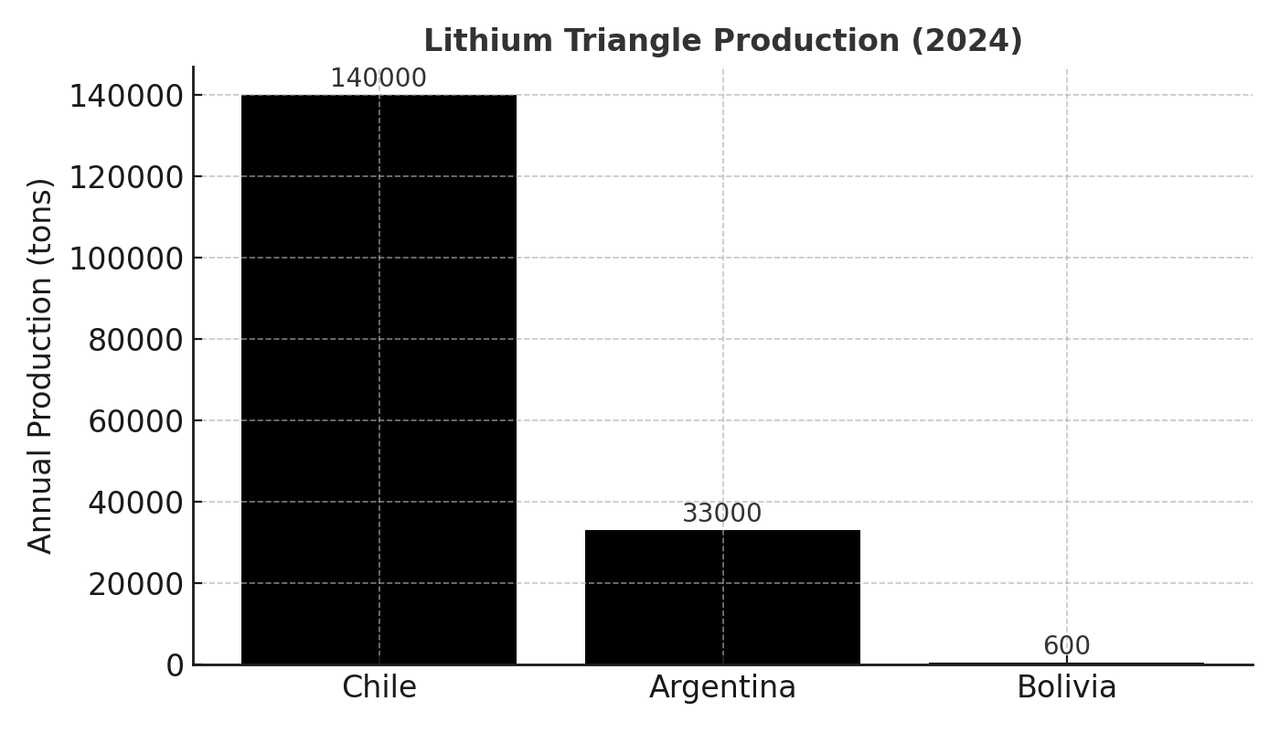

Three thousand kilometers southeast, a different extraction story unfolds across the high-altitude salt flats where Chile, Argentina, and Bolivia meet. The "Lithium Triangle" contains 56% of the world's lithium reserves, but the benefits rarely reach local communities.

Luisa Jorge, a leader in the indigenous community of Susques, Argentina, captured the frustration: "Lithium companies are taking millions of dollars from our lands… they ought to give something back. But they're not." While mining companies extract lithium worth billions, indigenous Atacama peoples receive annual payments ranging from just $9,000 to $60,000 per community.

The extraction process reveals the environmental cost of our battery-powered future. In one of the driest places on earth, miners drill holes in salt flats to pump mineral-rich brine to the surface, then let water evaporate for 12-18 months before lithium carbonate can be extracted. This process consumes vast amounts of water in regions where local communities already struggle with water scarcity.

Current production data shows the dramatic imbalance: Chile produces 140,000 tons per year, Argentina 33,000 tons, and Bolivia—with the world's largest lithium reserves—just 600 tons annually. Argentina expects to boost production by 75% in 2025 to 130,800 tonnes, mostly from new operations and expansions.

The Mirage of Plenty: Why Abundance Statistics Mislead

For over a century, resource pessimists have predicted imminent exhaustion of critical metals, only to be proven wrong as exploration and technology unlocked new deposits. Copper reserves remain twice what's projected to be needed through 2050, while undiscovered deposits could be 40 times larger than current proven reserves.

Yet this statistical comfort obscures a more troubling reality: extraction is becoming progressively more energy-intensive, environmentally destructive, and politically fraught. As easily accessible ore grades decline and geopolitical conflicts tighten supply chains, theoretical abundance offers little comfort for practical planning.

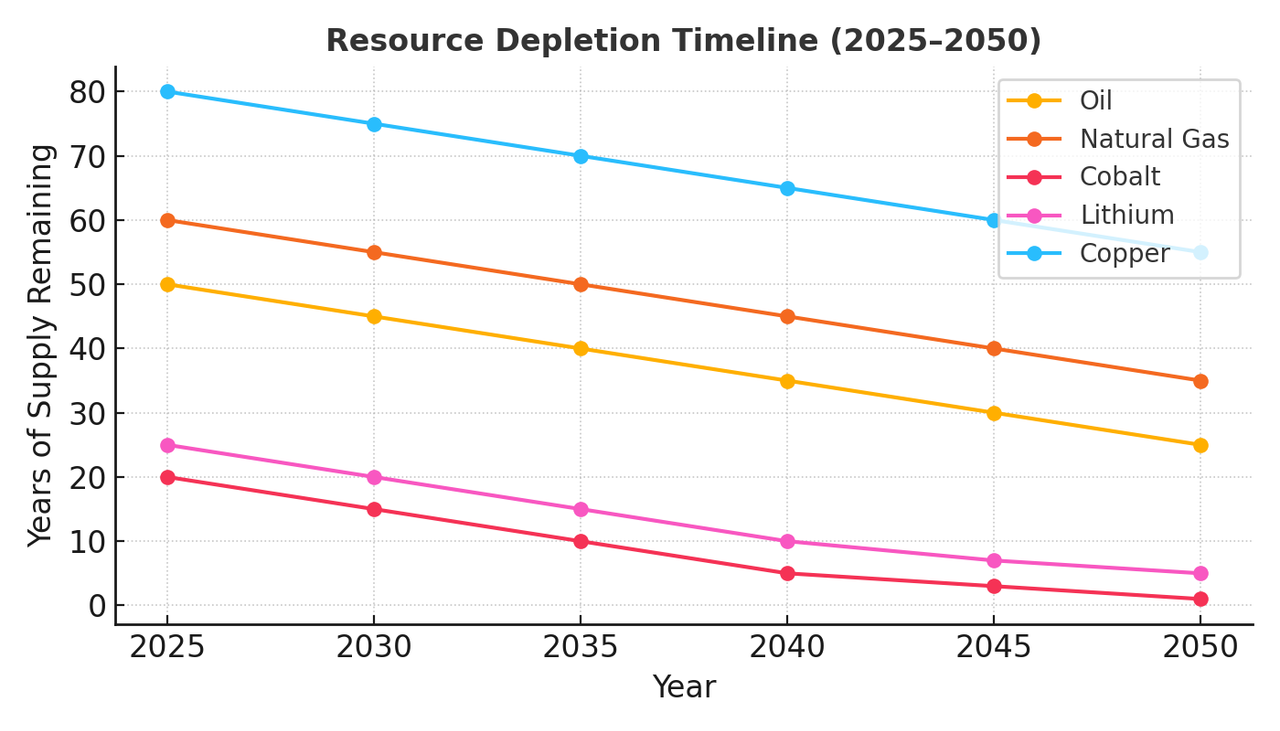

The numbers that matter tell a different story:

- Oil: 1.5 trillion barrels in proven reserves, 90 million barrels daily consumption, peak production projected around 2030s

- Lithium: 22 million tonnes in reserves, 130,000 tonnes current annual demand, with demand projected to quadruple by 2035

- Cobalt: 7.6 million tonnes in reserves, 190,000 tonnes annual demand, peak production expected 2025-2030

- Nickel: 95 million tonnes in reserves, 3.3 million tonnes annual demand, electric vehicle boom driving pressure by 2040

The International Energy Agency reports that lithium demand rose by nearly 30% in 2024, significantly exceeding the 10% annual growth rate seen in the 2010s, while demand for nickel, cobalt, graphite and rare earths increased by 6-8%.

The New Cold War: Critical Minerals as Weapons

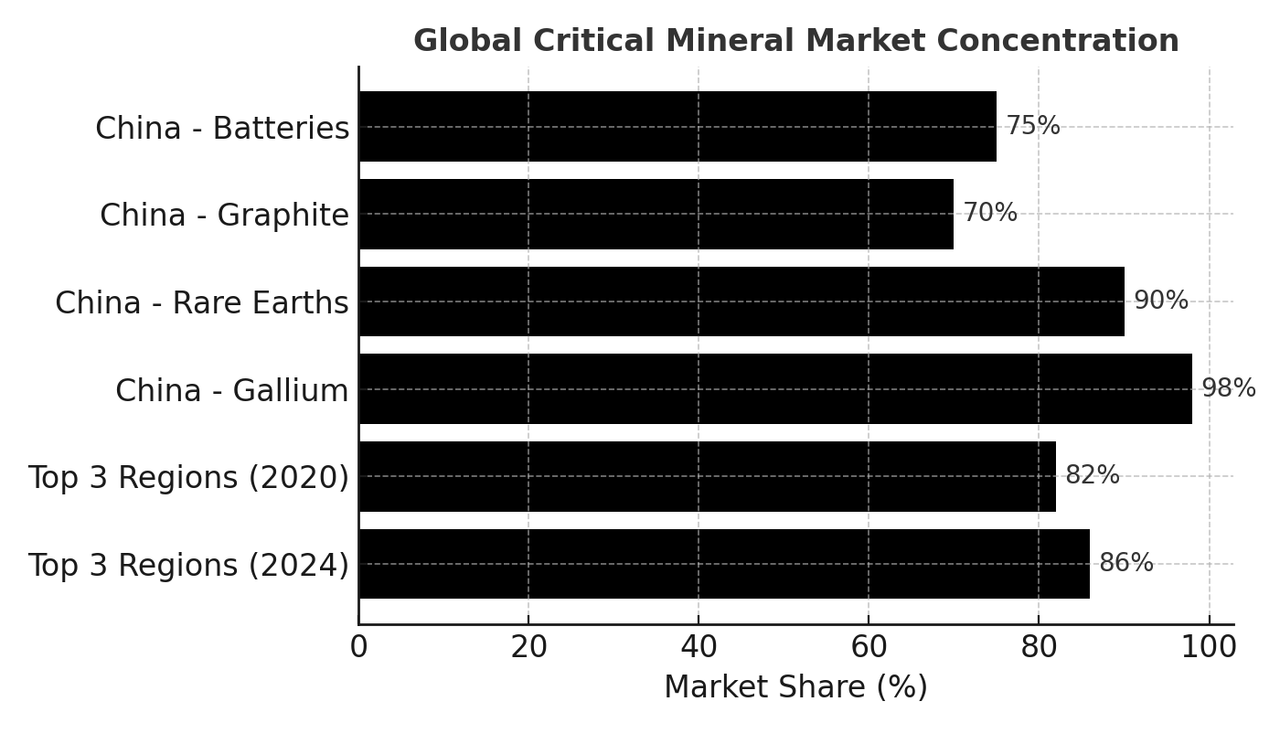

The geopolitical dimension of resource scarcity has already moved from theory to practice. In December 2024, China restricted exports of gallium, germanium and antimony—key minerals for semiconductor production—to the United States. This was followed by additional export controls in February 2025 on tungsten, tellurium, bismuth, indium and molybdenum.

The impact has been immediate: Chinese export restrictions imposed in 2024 have severely impacted production schedules at major defense contractors, with some programs facing 18-24 month delays. China accounts for more than 98% of global gallium production, giving Beijing unprecedented leverage over Western defense manufacturers.

The February 2025 crisis deepened when the DRC announced a four-month suspension of cobalt exports to curb falling prices, demonstrating how producer countries can weaponize supply disruptions. NATO responded by identifying 12 defense-critical raw materials in December 2024: aluminum, beryllium, cobalt, gallium, germanium, graphite, lithium, manganese, platinum, rare earth elements, titanium, and tungsten.

Oil: Still Scripting Global Conflicts

While attention focuses on future mineral bottlenecks, oil continues to script contemporary geopolitics with devastating precision. The war in Ukraine demonstrates oil's enduring strategic importance: Ukrainian drone strikes on Russian refineries create diesel shortages that ripple across global markets.

The complexity of oil geopolitics defies simple sanctions. India purchases discounted Russian crude, refines it domestically, then sells 15.5% of its diesel production back to Russia. Europe maintains public bans on Russian fuel while pipelines through Slovakia and Hungary continue operating, and indirect imports circumvent sanctions through increasingly elaborate routing schemes.

War itself represents massive oil consumption. At their peak, U.S. military operations in Iraq burned through an estimated 1.3 billion gallons of fuel annually—exceeding the total energy consumption of many small nations. Every missile launch, every sortie, every supply convoy operates on petroleum-based logistics. Oil is not merely fought over; it becomes an essential component of modern warfare itself.

When Supply Chains Fracture: The New Reality

The gap between resource availability and supply chain resilience has become dangerously apparent. Mine development timelines have lengthened from 8 years in the 1980s to over 12 years today due to increased regulatory complexity, community opposition, and technical challenges.

Investment momentum in critical mineral development weakened in 2024, with spending rising by just 5%, down from 14% in 2023. Adjusted for cost inflation, real investment growth was just 2%. Meanwhile, recycling infrastructure lags dangerously behind demand growth.

Critical mineral markets have grown more concentrated, especially in refining and processing. In 2024, the top three refining regions controlled 86% of the market for copper, lithium, nickel, cobalt, graphite, and rare earths, up from about 82% in 2020. Nearly all supply growth came from Indonesia for nickel and China for the other minerals.

Breakthrough Technologies: Glimmers of Hope

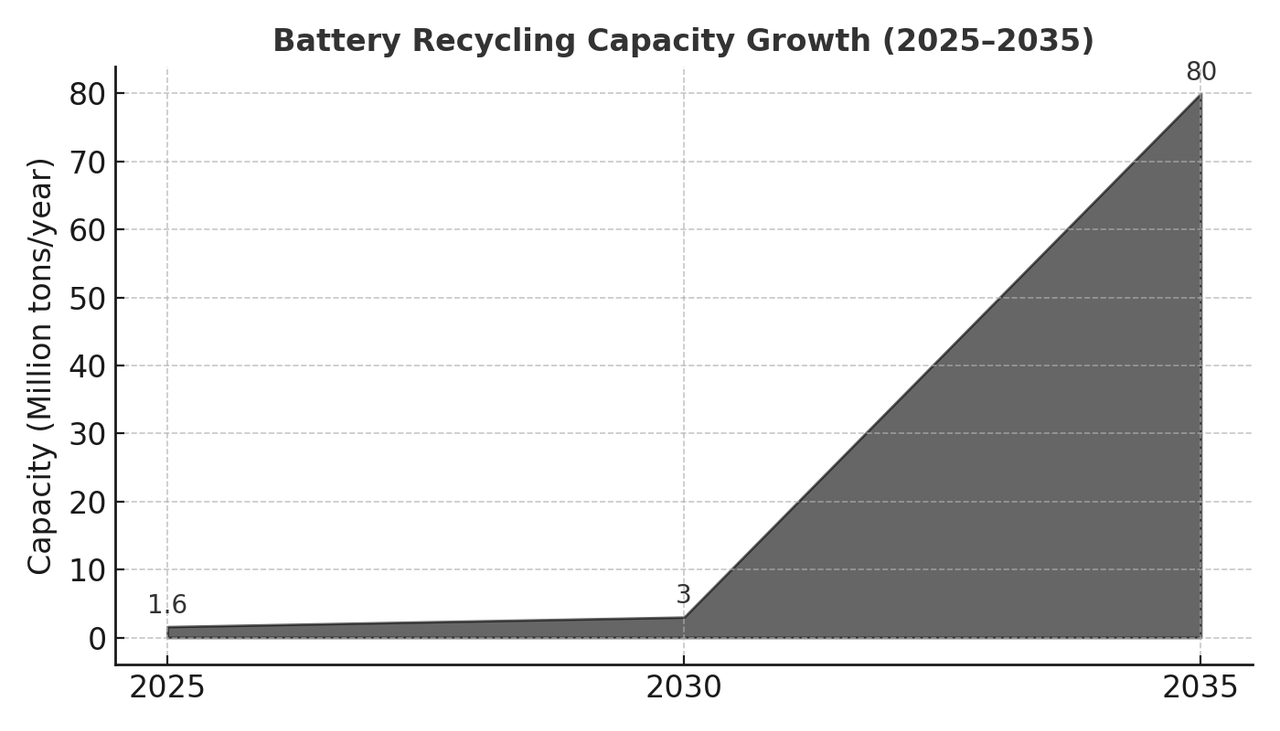

Despite systemic challenges, technological innovations offer pathways to reduce scarcity pressures. As of 2025, global lithium-ion battery recycling capacity stands at around 1.6 million tons per year, with planned facilities expected to push this above 3 million tons annually.

American Battery Technology Company secured a $144 million grant in 2024 from the U.S. Department of Energy to construct a second commercial-scale lithium-ion battery recycling facility with processing capacity of 100,000 tonnes per year. Their innovative "de-manufacturing" process challenges traditional methods like smelting and shredding, achieving high recovery rates of critical materials including lithium, nickel, cobalt, manganese, copper, and aluminum.

Researchers at Hong Kong University of Science and Technology revealed in 2025 a previously unrecognized atomic-scale mechanism that obstructs efficient battery recycling, providing a roadmap to overcome critical bottlenecks in lithium-ion battery recovery systems.

Major corporations are committing to recycled materials: Apple announced it will use 100% recycled cobalt in batteries by 2025, with its Daisy robot helping recover over 11,000 kilograms of cobalt from batteries since 2019.

Australia's Strategic Response: A Case Study in Resource Diplomacy

Australia represents perhaps the most comprehensive national response to critical mineral scarcity. The country retained its position as the world's top lithium producer in 2023 (49%) and was also a top five producer for cobalt (2%), manganese ore (9%), rare earths (8%), and several other critical minerals.

The Australian Government committed A$566.1 million over 10 years from 2024-25 to deliver data, maps and tools for the resources industry, with around 80% of Australia still 'under-explored' according to Geoscience Australia.

As former Prime Minister Kevin Rudd noted, "Most of the periodic table is under our soil," giving Australia unique advantages among developed nations. The country offers democratic governance, environmental standards, established supply chains, and proximity to major Asian markets.

New South Wales alone expects capital investment of more than $7.6 billion, over 2,700 ongoing jobs, and 4,600 construction jobs in regional areas if critical minerals projects proceed as planned.

The Defense Sector Awakens

The national security implications of mineral dependence are driving unprecedented policy responses. In March 2025, President Trump signed an executive order invoking emergency powers under the Defense Production Act, directing federal agencies to identify mines for quick approval and expediting permitting processes for critical mineral projects from typical timelines of 7-10 years to 3-5 years.

The Defense Advanced Research Projects Agency launched the Open Price Exploration for National Security program, awarding Charles River Analytics a $4.5 million contract to build AI-driven prediction models for critical mineral markets.

The Path Forward: Three Scenarios

The Optimistic Path: Innovation and Cooperation

Recycling technologies achieve commercial scale rapidly, alternative battery chemistries like sodium-ion systems reduce pressure on scarce materials, and African nations successfully leverage mineral wealth to fund genuine development. Resource nationalism evolves into a stabilizing rather than destabilizing force, with producer countries capturing greater value while maintaining reliable supply relationships.

Key indicators: Battery recycling capacity increasing by the required factor of 50 over the next decade, breakthrough in direct lithium extraction reducing environmental impacts, and successful implementation of fair trade frameworks for critical minerals.

The Muddled Middle: Managed Scarcity

Supply chains experience periodic disruptions but avoid complete breakdown. Regional conflicts flare around resource access points, electric vehicle adoption slows under material constraints, and the energy transition proceeds unevenly across regions and economic sectors. Innovation continues but faces material bottlenecks constraining deployment speed.

Key indicators: Continued price volatility in critical minerals, partial success of recycling initiatives, geopolitical tensions managed through strategic stockpiles and bilateral agreements.

The Crisis Scenario: System Breakdown

Cobalt supply shortages appear inevitable in the short- to medium-term (2028-2033), even under the most technologically optimistic scenario. Lithium supply chains strain under explosive demand growth, oil-related conflicts intensify, and the global economy staggers under resource-driven cost inflation. Technological innovation stalls from inability to access affordable materials for implementation at scale.

Key indicators: Sharp spikes in critical mineral prices driving up battery costs by 45% or more, widespread supply disruptions, acceleration of resource conflicts.

What This Means for You

The resource transition will reshape daily life in concrete ways:

- Energy Costs: Mineral scarcity could increase electric vehicle prices significantly, slowing adoption and maintaining gasoline dependency longer than planned.

- Technology Prices: Smartphones, laptops, and other electronics may become more expensive as critical materials grow scarce.

- Employment: New job opportunities in recycling, mining, and green technology manufacturing, but potential losses in traditional energy sectors.

- Investment Implications: Critical mineral stocks, recycling technologies, and companies with diversified supply chains may outperform those dependent on concentrated sources.

- National Security: Citizens may face trade restrictions, strategic material shortages, and potential conflicts over resource access.

The Political Reality of Scarcity

The uncomfortable truth underlying all resource projections is that every pathway forward is fundamentally political rather than purely technical. Minerals are not merely physical commodities; they function as diplomatic bargaining chips, economic weapons, and geopolitical lifelines.

Current resource consumption patterns reflect political choices about distribution, access, and priorities rather than immutable physical constraints. The challenge of resource scarcity cannot be solved through technological innovation alone—it requires deliberate political decisions about how societies organize production, consumption, and global trade relationships.

Immediate Action Steps

For Policymakers: Accelerate permitting for domestic critical mineral projects; invest in recycling infrastructure and R&D; develop strategic stockpiles of most vulnerable materials; strengthen partnerships with reliable supplier nations; create incentives for alternative battery chemistries.

For Businesses: Diversify supply chains beyond single-source dependencies; invest in recycling and circular economy practices; develop long-term supply agreements with multiple suppliers; consider alternative materials and technologies; build resilience into operations planning.

For Individuals: Support companies with sustainable sourcing practices; extend device lifespans through repair rather than replacement; participate in electronics recycling programs; stay informed about supply chain issues affecting purchases; consider investment implications of resource scarcity.

The Countdown Has Begun

The window for meaningful course correction is narrowing rapidly. Investment in critical mineral development has already slowed, exploration activity has plateaued, and geopolitical tensions are escalating export restrictions. Meanwhile, demand continues to surge driven by the urgent need for clean energy technologies.

Back in the cobalt mines of Congo, twelve-year-old Muntosh continues his dangerous work, unaware that his daily labor connects him to the global struggle over humanity's energy future. In Silicon Valley, engineers design ever more sophisticated devices, largely insulated from the human and environmental costs of their material requirements.

Unless we treat resource constraints as the immediate emergency they represent, the future will be defined not by human ingenuity and technological progress, but by the grinding logic of material attrition. The countdown has already begun; the only question is whether we choose to acknowledge it while meaningful options remain available.

This analysis is based on current reporting, government data, industry research, and academic studies covering resource availability and supply chain vulnerabilities across critical commodities. All statistics and quotes are sourced from reputable organizations including the International Energy Agency, U.S. Geological Survey, academic institutions, and documented field research.

Add comment

Comments